How to claim Rent Tax Credit Ireland 2023

The Rent Tax Credit was brought into legislation in December of 2022. To some people the topic of taxes and tax credits can be daunting and arduous however, if you follow this guide claiming your Rent Tax Credit will only take 5 minutes!

How is it calculated?

Before we go into the step by step guide it’s important to know how the figure you receive is calculated. The Rent Tax Credit is 20% of the total rent you have paid in that year. If you have paid 1500 so far in the year and you decide to claim Rent Tax Credit you will receive 300. The limit of this is 2500 euro so the maximum claim you can make is 500 euro.

With this in mind you can maximize your Rent Tax Claim by waiting until you have paid 2500 in rent that year to claim the full 500 instead of just claiming it as soon as possible.

What you will need

- Revenue login details

- PPS Number

- Start and end date of your tenancy

- Property address and Eircode

- Landlord or managing agency name

- Figure for total rent paid in the year

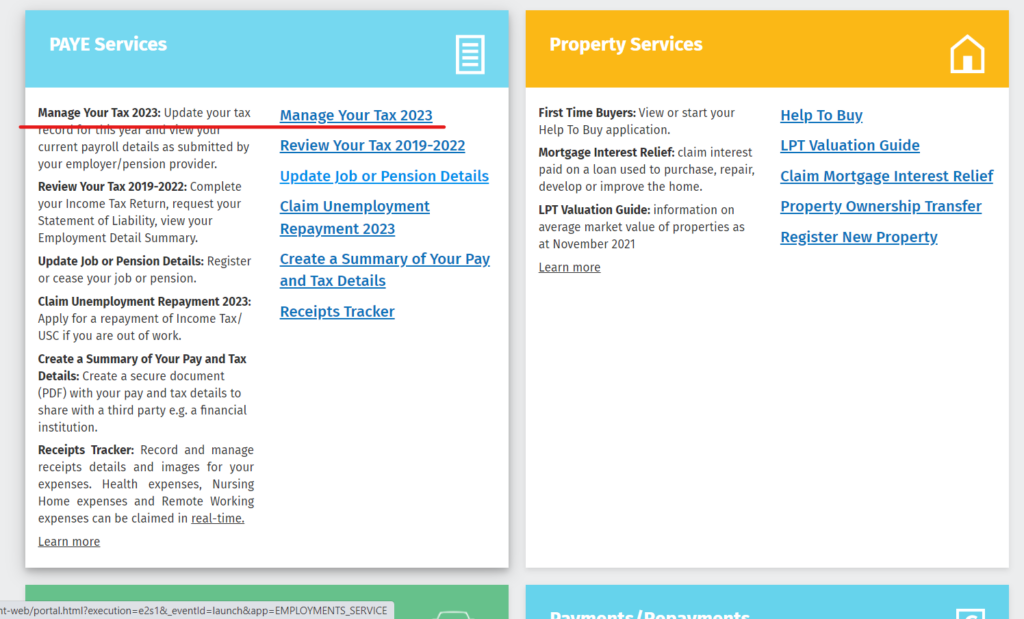

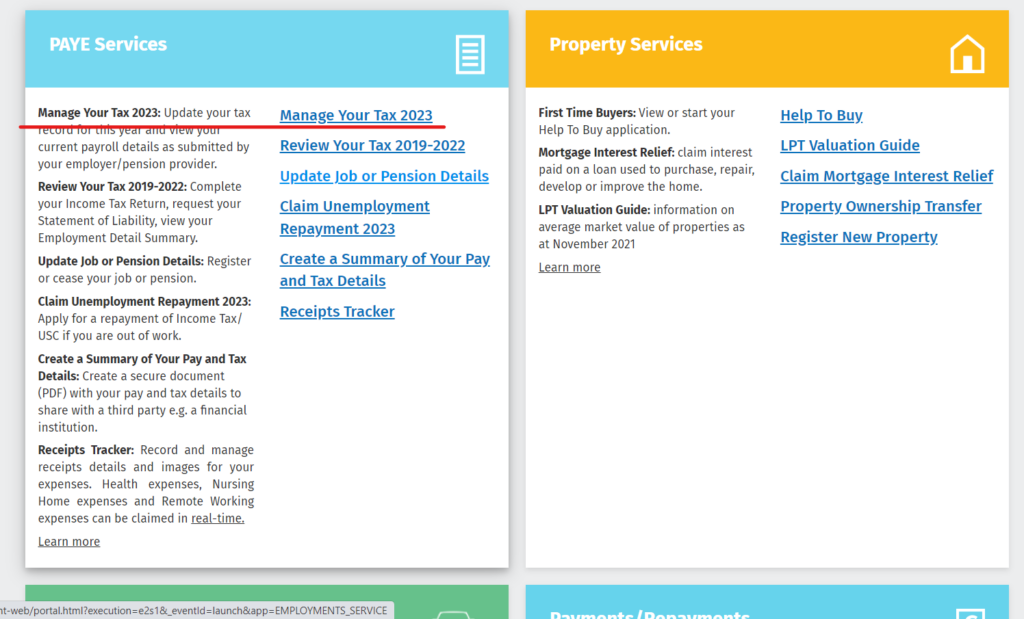

Step 1: Log into myAccount on Revenue and go into “Manage Your Tax”

Go to revenue.ie and under PAYE services you will see a section saying “Manage Your Tax 2023”

Step 2: Scroll down to Tax Credits and click Add Tax Credit.

After clicking into the Manage your Tax you can scroll down and you’ll find a Tax Credits section. Here you can add new credits. Once you select Add Tax Credit you will find the Rent Tax Credit under the Family section.

Step 3: Proceed to fill in the information requested.

Make sure to pay extra attention to the small red star * next to the boxes. Some information that might be a hassle to acquire such as your RTB number aren’t actually necessary to claim the Rental Tax Credit.

Step 4: Submit

Claiming the rent tax credit is a straightforward process. You just need to calculate how much rent you paid during the year and use that to determine your credit. It’s an easy way to lower your taxes and keep more of your money.