Understanding the Irish Housing Crisis: Factors and Causes.

The phrase “housing crisis” has become all too familiar in Ireland today, with the media bombarding us with buzzwords such as “vulture funds”, “social housing”, and “cuckoo funds”. Despite this constant stream of information, we have only a vague understanding of the specific root causes that led us to this situation. In this blog, we aim to provide a chronological account of the events that contributed to the current housing crisis. To make this information more digestible, we have provided a condensed summary of the key points at the bottom of the blog.

The Celtic Tiger

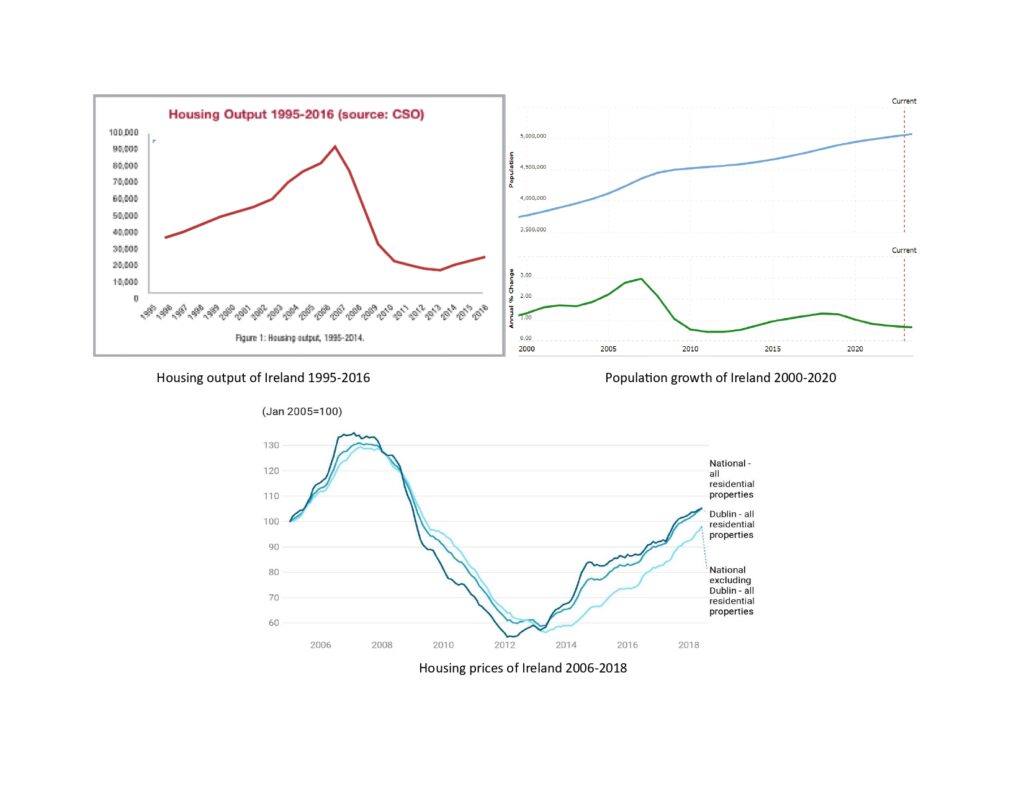

The housing situation we face today can be traced back to the Celtic Tiger era in Ireland, when the economy was booming and GDP increased by 229%. This led to a construction and housing boom, resulting in over 90,000 dwellings being built in 2006 alone. However, at the height of the Celtic Tiger, the government made a critical mistake by ceasing the construction of social housing, which introduces affordable homes into the market and prevents private companies from pricing residential properties exorbitantly. By placing the responsibility of building affordable housing solely in the hands of private corporations, the government failed to consider the long-term impact of their decision. While this may have made sense during the housing boom, it left the public at the mercy of corporations whose primary objective is to benefit their shareholders, not the people. This lack of foresight has contributed to the current housing crisis.

The Housing Crash Occurs

During the Celtic Tiger era, bank loans were not adequately regulated, resulting in a large number of Non Performing Loans that were not being paid back. When the market crashed, construction came to a complete halt, and although home prices dropped, the lack of construction led to a significant shortage of dwellings. In 2014, only 10,000 units were built, a stark contrast to the 90,000 homes built in 2006. As the population of Ireland continued to increase, the supply of homes dwindled. Private corporations were the only ones building homes, and they were free to charge exorbitant prices. This was compounded by the government’s decision to stop building social housing during the Celtic Tiger era. While only 10,000 homes were built in 2014, the overall price of housing rose by 16.4%.

Introducing Vulture Funds

During the Celtic Tiger, Irish banks faced a significant number of Non-Performing Loans that they could not manage. To alleviate their burden, they sold all these loans to Foreign Property Funds at heavily discounted prices, commonly known as vulture funds. These funds would then pursue financially struggling families and individuals relentlessly through the legal system, often resulting in the repossession of properties. The Irish government actively facilitated this practice by providing tax breaks to encourage foreign firms to invest in the domestic housing and mortgage market. Additionally, the legal system enforced the right of these funds to collect the full value of the loan instead of what they paid for it. Although the NPL ratio decreased, the cost of these actions was borne by homeowners, with non-banks now owning 54% of all loans over one year in arrears. Repossessions continue, with court officials sidelining homeowners.

To break it down in very simple terms vulture funds bought debt at heavily discounted prices, resulting in the repossession of properties through the legal system, actively facilitated by the Irish government through tax breaks and legal enforcement. This resulted in more property being taken out of the hands of Irish citizens and into the hands of foreign corporations.

The Impact of Cuckoo Funds on the Irish Property Market

Cuckoo funds are large investment firms that buy up large numbers of residential properties in Ireland with the intention of renting them out, rather than selling them on the open market. They are named after the cuckoo bird, which lays its eggs in other birds’ nests and leaves them to be raised by the unwitting host bird.

In recent years, cuckoo funds have become a controversial issue in Ireland, as they have been blamed for driving up property prices and making it more difficult for young people and first-time buyers to get onto the property ladder. These funds are often able to outbid individual buyers, and they can offer cash deals and quick sales, which can be very attractive to sellers who want to sell quickly.

The impact of cuckoo funds on property prices in Ireland is complex, and opinions are divided. Some argue that they have helped to boost the supply of rental properties, which has made it easier for people to find homes to rent. However, others argue that their presence has made it more difficult for individuals to buy homes, as they are often outbid by these large investment firms.

There are concerns that cuckoo funds could have a negative impact on the wider economy as well. If property prices continue to rise rapidly, it could lead to a housing bubble, which could ultimately burst, leaving many homeowners in negative equity. This could have knock-on effects on the wider economy, leading to a recession or even a financial crisis.

In response to these concerns, the Irish government has introduced a number of measures aimed at curbing the influence of cuckoo funds. For example, it has introduced a 10% stamp duty on the purchase of 10 or more residential properties in Ireland. It has also introduced measures to encourage more first-time buyers onto the property ladder, such as the Help to Buy scheme.

Cuckoo funds have become a controversial issue in Ireland, with many people blaming them for driving up property prices and making it more difficult for young people to buy their own homes. While the impact of these funds on the wider economy is difficult to predict, it is clear that the Irish government is taking steps to try to mitigate their influence and promote more affordable and accessible housing options for everyone.

To summarize some of the main causes of our current housing climate are:

- The Celtic Tiger causing the halt of social housing in Ireland

- The recession stopping the construction of dwellings.

- Vulture funds seizing property assets from the people of Ireland

- Banks having stricter mortgage regulations for developers slowing down the process of building new dwellings

- Cuckoo funds buying new residential developments and reintroducing them into the market at unaffordable prices.

There are myriad reasons why our country finds itself in the difficult situation it currently faces. While the housing crisis is one of the most pressing issues, it’s important to acknowledge that solving it won’t be a quick fix – it will take years of sustained effort. However, what is clear is that the lack of action from our government speaks volumes about the competency of those currently in power. Rather than taking steps forward, we seem to be moving backwards, and unless emergency measures and swift actions are taken, we risk being stuck in this situation for decades to come.